Text by Laura Netz

On April 5 and 6, 2019, at Kunstquartier Bethanien in Berlin, Dark Havens took place, a series of talks and workshops to explore the inner mechanism of the financial system, crime, corruption and wrongdoing hidden by secretive offshore companies. Dark Havens is organised by Disruption Network Lab, an ongoing platform and research focused on art, digital rights, and disruption. The Laboratory’s programme is run by Tatiana Bazzichelli, artistic director and curator, and a team of collaborators.

Among the panellists were Nicholas Shaxson, (Journalist, author of Treasure Islands, Finance Curse, UK/DE), Maira Martini (Knowledge Coordinator, Transparency International, BR/DE), Simon Shuster (Reporter for TIME, RU/DE), Ryan Gallagher (Investigative Reporter & Editor, The Intercept), Friedrich Lindenberg (Civic Technologist, Organised Crime and Reporting Project), Khadija Ismayilova (Investigative Journalist & Radio Host), and Michael Hornsby (Communications Officer, Transparency International).

Dark Havens is a space to meet people worldwide who have participated in global investigations and leaks and are whistleblowers in their corporations, facing trials and other risks. Dark Havens analyses the themes of tax havens and financial corruption through art, technology and activist practices and follows the scandal of Panama Papers. The huge leak of data containing info about secretive offshore companies occurred in 2016 when an anonymous whistleblower revealed 11.5 million financial and legal records from the Mossack Fonseca law firm, under the fake name of “John Doe”, to Bastian Obermayer, an investigative journalist, who with Frederik Obermaier shared the information with the International Consortium of Investigative Journalists (ICIJ).

The core intention of the Dark Havens is to explore issues of security and openness in processes of revealing misconduct and wrongdoing of the powerful. Dark Havens promotes the participation of international speakers involved in leaks, investigations, whistleblowing practices, and acts of truth-telling that have suffered risks, trials, and crimes in the task of accusing financial corruption, wrongdoing, and tax havens. Dark Havens denounces the secretive offshore tax havens global network and the relationships, connections, and spider web built by financial experts, bankers, accountants, worldwide institutions, laws, governments, and corporations. The offshore system links to global economic power, revealing an asymmetrical wealth distribution and culminating in global economic financial crises.

Furthermore, Dark Havens questions the global monetary flows’ obscurity, hidden financial transactions, and secrecy laws, which bring inequality, risks, and poverty. According to Jonh Doe, in John Doe’s Manifesto, in this system – our system- the slaves are unaware both of their status and of their masters, who exist in a world apart where the intangible shackles are carefully hidden amongst reams of unreachable legalese. The horrific magnitude of detriment to the world should shock us all awake.

On April 5, Dark Havens presented the film screening of The Panama Papers (2018, USA, 94 min), a documentary by Alex Winter, produced by Laura Poitras. The Panama Papers documentary reveals that corrupt power-brokers are manipulating world governments and big business. The Panama Papers is the largest global corruption scandal in history.

Rich, elected officials, dictators, cartel bosses, athletes, and celebrities were clients of the law firm Mossack Fonseca accused of practices of tax evasion, fraud, bribing government officials, rigging elections, and murder. Laura Poitras is also the director of Citizenfour (2014), a documentary revealing Edward Snowden’s information about illegal wiretapping practices of the US National Security Agency (NSA) and other intelligence agencies. Furthermore, Laura Poitras collaborated with the American artist Trevor Paglen, who realised quite quickly that Edward Snowden’s documents described a physical network of cables, which carry the world’s information. The work was presented in the C-print series NSA-Tapped Fiber Optic Cable Landing Site, 2014.

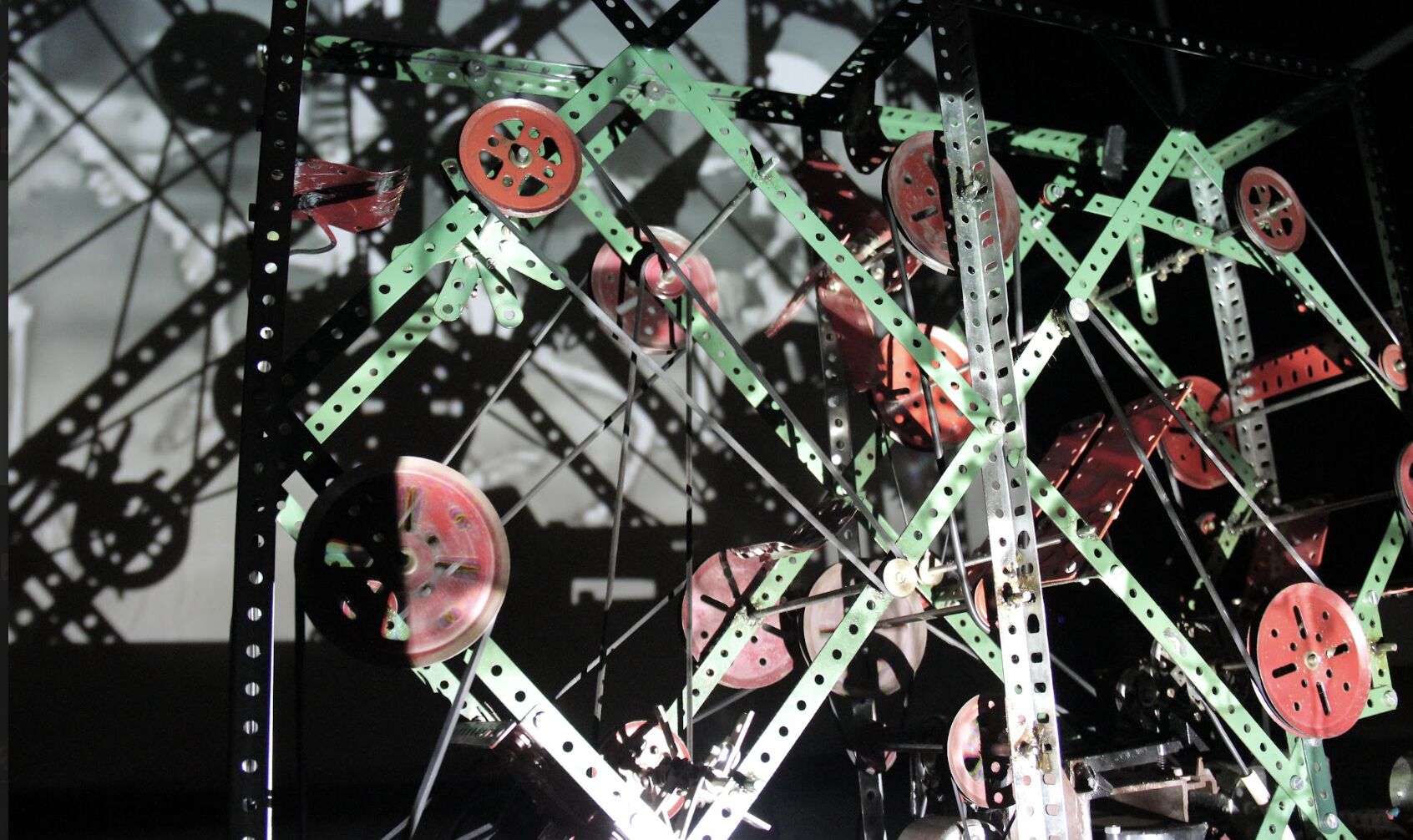

Dark Havens continued on April 6 with the artist talk by RYBN.ORG (Extra-disciplinary Artistic Research Platform, FR) who presented The Great Offshore project, an artistic investigation on tax havens locations. Using Situationist strategies in a psycho-geographic mapping, the work represents offshore finance’s physical locations and traces the transnational and financial liquid industry.

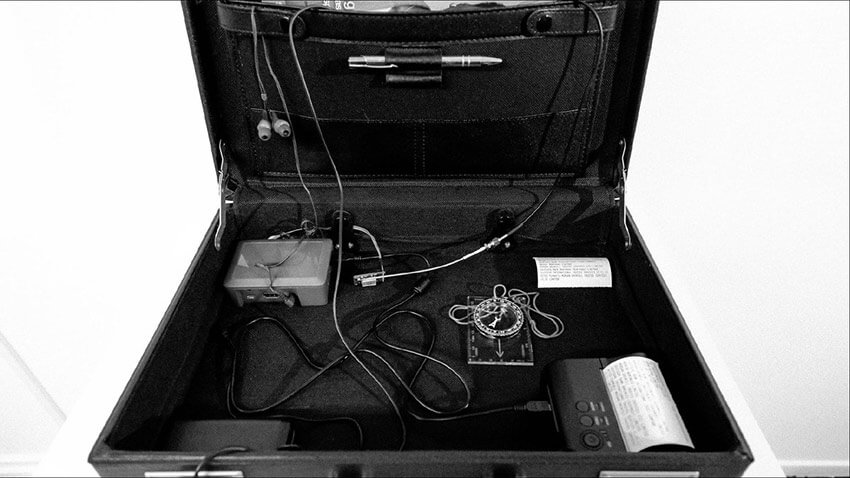

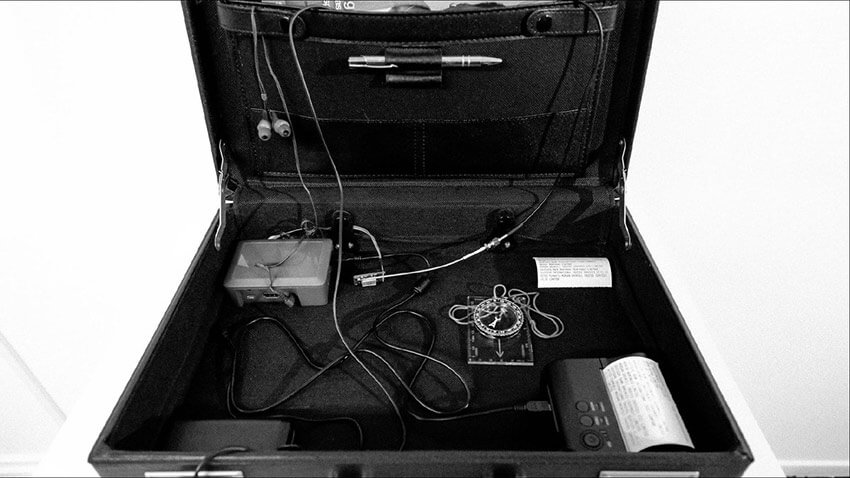

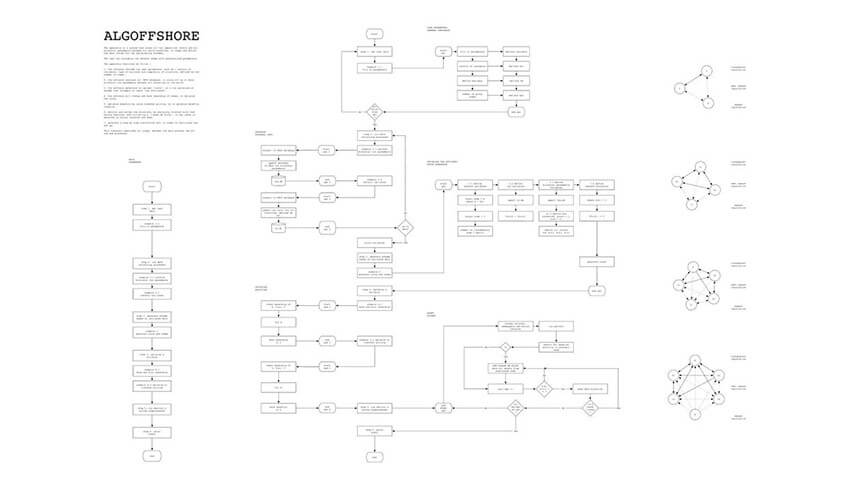

Alain Deneault declares, the vocabulary in use to describe offshore finance is not neutral and produces a positive, technical, legal and legitimate picture that neutralises critics”. RYBN.ORG also offered the workshop The Offshore Tour Operator on April 7, where using a psycho-geographic GPS prototype through audio indications, equipped with a compass, and accessing the database of the Panama Papers, RYBN.ORG proposed the practice of deriving to trace in the physical infrastructure of the city territory, the hidden structures of offshore financial trading and practices of tax evasions. RYBN.ORG is a Paris-based collective founded in 1999 investigating and developing high-frequency markets structure, algorithmic trading, and digital labour.

The Keynote speaker on April 6, Frederik Obermaier (Investigative Journalist, Sud-Deutsche Zeitung, DE) introduced the process of the leak of The Panama Papers, considering it such as one of the greatest scandals of fraud in history with such huge 2.6 TB of data revealed. Frederik Obermaier paid attention to John Doe’s anonymity, the whistleblower who leaked the papers, who is still an unknown identity. Frederik Obermaier explained how he received a cryptic message from John Doe, offering data from Mossack Fonseca.

This Panamanian law firm helped prime ministers, kings, presidents, dictators, drug cartels, Mafia clans, fraudsters, weapons dealers, and regimes like North Korea or Iran. Frederik Obermaier, with Max Heywood, also addressed the arrests, changes in legislation, the step down of several heads of government, the launch of investigations and the one billion $ recouped as an impact resulting from the leak. Moreover, Frederik Obermaier stated the current potential risks of investigative journalists and denounced cases such as Daphne Caruana Galizia, an investigative journalist from Malta who was assassinated on October 16, 2017, and Jan Kuciak. Frederik Obermaier is a Pulitzer-Prize-winning reporter based in Munich and is also a member of the International Consortium of Investigative Journalists (ICIJ).

Dark Havens exposes the international situation of many countries that rule and manage through secrecy jurisdiction. Nowadays, the situation in Britain is a response to the empire’s demise, when the City of London’s financial interests created a web of secrecy jurisdictions that captured wealth from across the globe. According to The Spider’s Web documentary by Michael Oswald, the British Empire was the largest. Still, once it fell apart and countries gained independence, the British elite of wealth privileged searched for a new method in finance to preserve their privileges.

Through an agreement never written, the Bank of England established protective measures for London to become the Euro market (not in the UK, but elsewhere). In this way, the American $ avoided EU regulations, and the US financial market moved into London. The system is based in a secrecy jurisdiction of illegal activities such as tax evasion. The City of London, the London financial district, is an estate within an Estate, known as the City of London Corporation within an independent legal status since the Middle Ages (1066) from Britain.

The City of London is structured through lobbies, and a representative sits in the House of Commons. In this way, the powerful economy of the City of London shapes British policies and financial methods. The secrecy jurisdiction is based on the old system of Trusts, a mechanism of obscurity since the Crusades and the creation of foreign lands assets trusted stewards. Trusts represent the ownership of someone’s assets. A trustee is generally a lawyer and is the figure created to be exempted from taxes through no connection in place and no trace. The trustee sets up a Trust, but there is no register, no traces, and there are no obligations of reports. So, the Trust becomes invisibly protected by secrecy jurisdiction.

Moreover, there is a link between politicians and Trusts in offshore companies. British politicians have been accused by Brussels of questionable lobby practices in the City of London. The worst of it is the Government tax avoidance scheme, set to protect crazy business models, which is denying and cutting funding from public services. For instance, the HM Revenue & Customs, the UK Tax authority deals and negotiates individually and in closed doors with private corporations.

Dave Harnett, Head of the HMRC, under taxpayers’ confidentiality, did not give information when asked about the mafia in the state and why tax authority is ruled by laws, politics, the City of London, and bankers who are sending money to offshore territories to avoid paying taxes. The complexity and obscurity of hidden tax havens culminate in the creation of the Private Funding Initiative (PFI), which promotes private sector funding. The HMRC advises implementing PFI by public authorities and recommends that the tax authority go offshore. Big banks and other corrupted businesses have penetrated the Government.

So, most government tax avoidance diminishes public funding and increases the making of private neoliberalism corporations and foundations. This undermines the social and human rights of citizens. Privatisations promoted by secrecy systems and tax havens are directly linked with processes of colonial independence, establishing a post-colonialist submission and dependence on fraud, secrecy and obliteration of social justice—the power of the few against the benefits of all.

However, what will happen when tax havens begin using cryptocurrencies? How will the state regulate taxpayers? Will cryptocurrencies favour these practices of tax evasion? How can technology provide tools to citizens to contribute to a more equalitarian societal system? This Dark Havens event was the first one of The Art of Exposing Injustice by Disruption Network Lab.