Interview by Ashley Lee Wong

Paolo Cirio launches a new artwork and intervention in the art market called Art Derivatives1, a website, financial instrument and campaign. Known for his tactical media artworks,

such as The Wall Street Journal, Financial Times, and The Economist. In the form of online platforms and social interventions, his project, such as Daily Paywall (2014), scrapped articles from paid news websites and distributed them for free.

In Loophole for All (2013), in which he won the Ars Electronica Golden Nica award, Cirio scraped a list of offshore companies registered in the Cayman Islands and allowed users to purchase a shell company’s corporate identity for 99 cents to use for their off-shore tax purposes. His work seeks to ‘democratise’ systems of finance to allow anyone to participate at low costs while also subverting and making visible their logic.

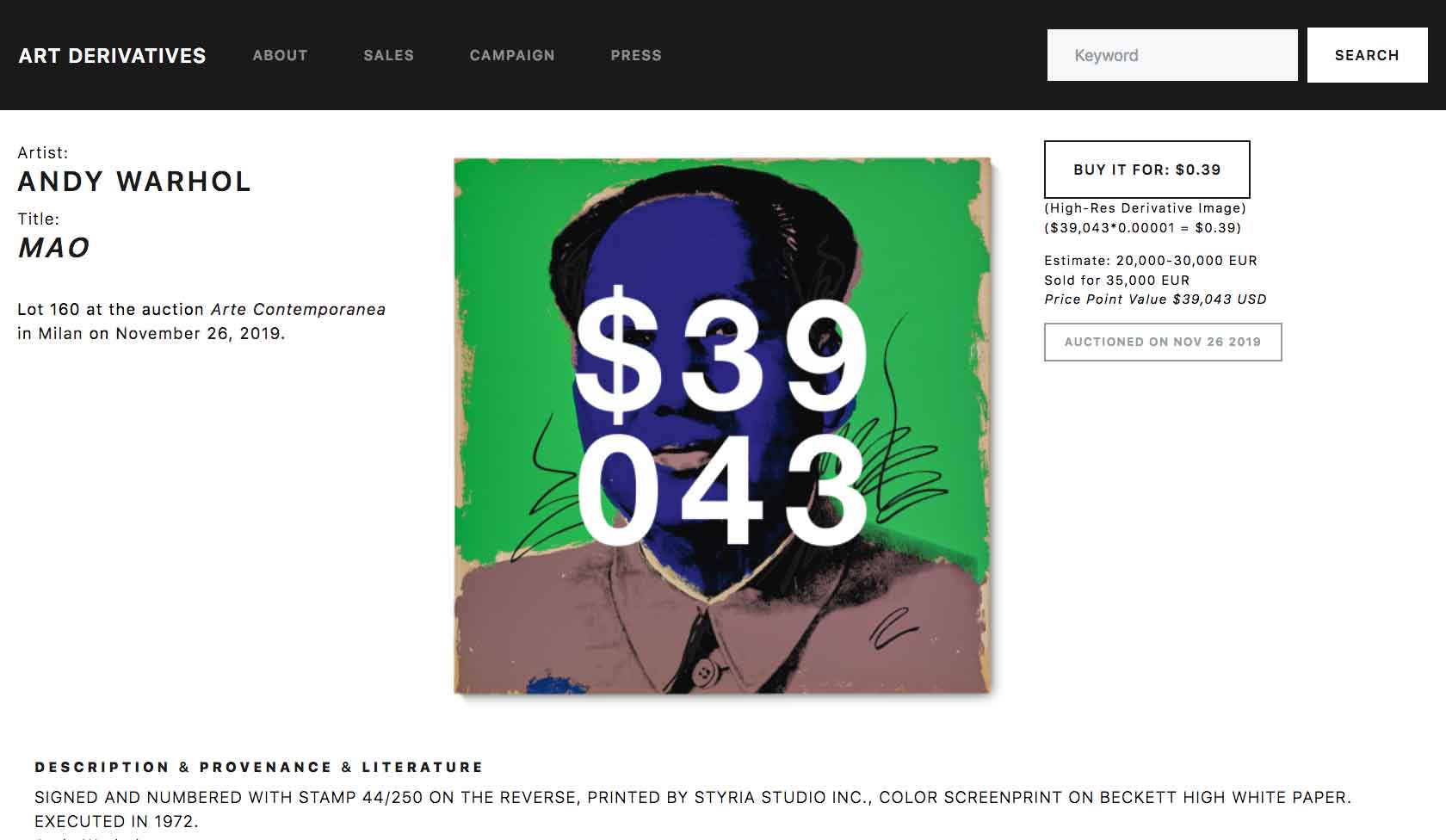

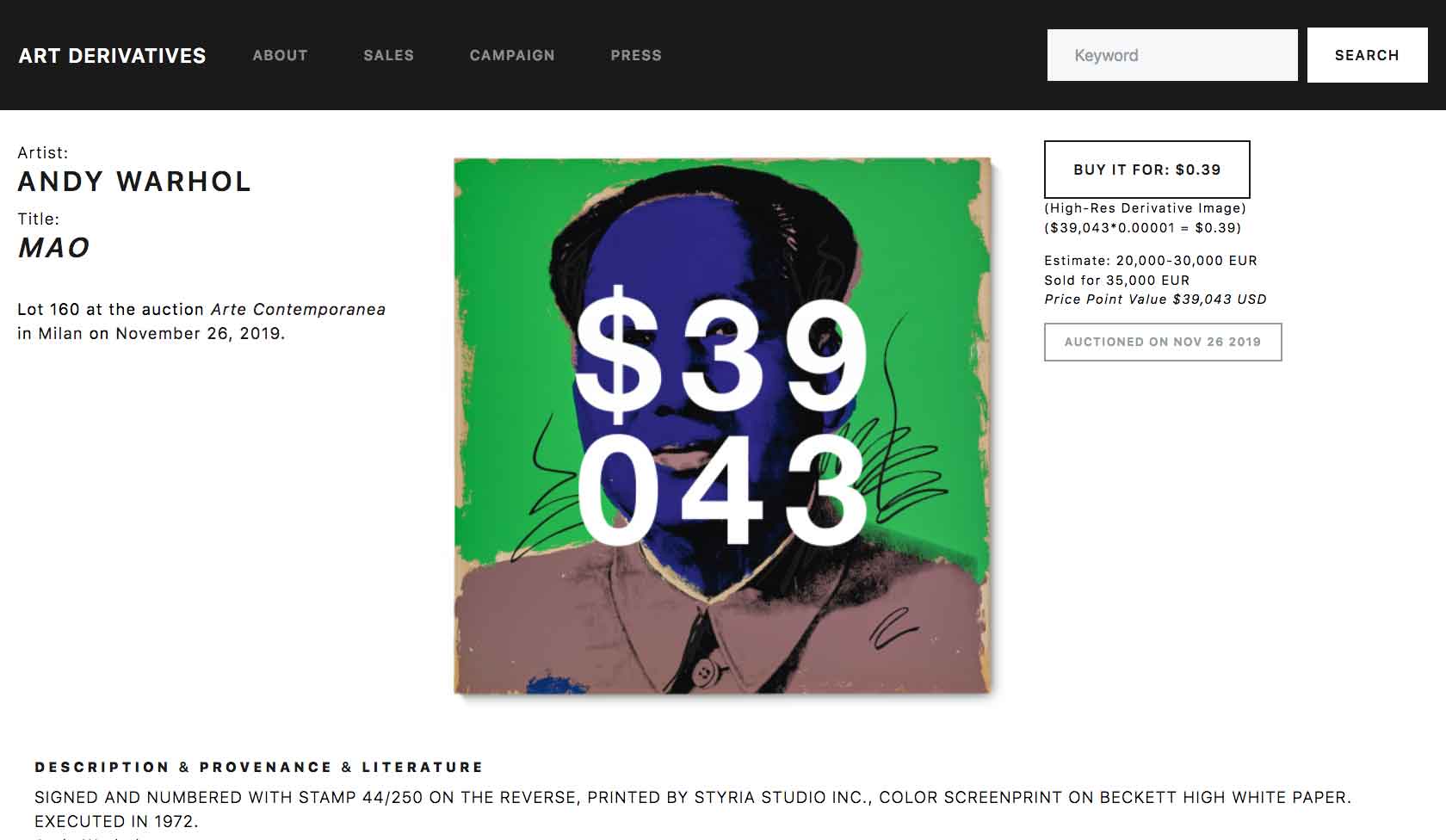

His latest work, Art Derivatives, aims at the art market by creating a website from images and auction data scraped from Sotheby’s website with the price overlaid on top. It creates a gesture of iconoclasm but also serves to bring transparency to its price as part of a campaign to promote neutrality and regulation of the art market.

Art Derivatives was first shown in an exhibition titled Image Rights2 at NOME Gallery in 2019, with the images printed on canvas as an extension of the website. The work is currently on display Information Critique3 on Jul 4 – Aug 22, 2020, at Museum PAN, Palazzo delle Arti Napoli, Naples, Italy.

For you, what are the key problems with the art market?

First of all, there is a total lack of transparency in the art market that starts at school, including business and law schools. No one teaches how trade works in art. Only after being in the field for several years with financial losses and through experience and contact with insiders can one eventually acquire know-how of the market. Often, it is only to discover that it doesn’t work at all or only by embracing unfair and bad business practices.

The reason why it’s not working is the lack of regulation in the market. As with any game without rules, there is no chance to play it right. Regulation in this market is not only needed for tackling abuses in the trade, for instance, manipulation and secrecy, but also for a healthy market by tackling monopolies, supply and demand, evaluations, and the labour that make all this happen. At the moment, there is none of this.

I believe art auction houses are central to these issues. These institutions control the market and dictate standards. They are monopolies that decide who can resell and at what price. They justify secrecy and manipulation in the market as normal and necessary. They are so authoritative that they can regulate themselves and set rules for the entire market. I think it’s the time to strip these institutions from their aura, glamour, and domination.

Opacity serves art auction houses well with secrecy, collusion, money laundering, and the evasion of international controls on tariffs, taxes, and even cultural heritage. It causes cascading damages throughout the industry. What is more, the lack of regulation has allowed major art auctions to gain unprecedented control of art prices, market practices, and even the careers of emerging artists along with their potential success.

How does Art Derivatives subvert these logics?

Art Derivatives is a direct provocation to the market of art auctions. I took their inflated and speculative values, and I let everyone bet against them to show how those values are questionable. By selling derivative works for a small fraction (0.00001 per cent) of the price or estimate publically reported, financial speculation in the art market is democratised, and the values of the artworks are distributed to everyday investors.

For instance, a work sold for $10m is available at $100 and works sold for $10,000 can be as little as $0.01. As a form of financial activism, the art auction market is shorted by borrowing its assets and selling them as future derivatives for a lower amount. If, in the future, the original works fail to sell at auction for higher prices, then the derivative artworks double their financial appreciation.

This betting against the weakness of the art auction market seeks to raise funds for the regulation campaign. Through extensive research, I composed a list of practices4 in the art market that must be regulated. This provocation with the sales of these derivative works is meant to support this investigation and campaign to regulate art auctions. Ultimately, the project promotes market neutrality, regulation, and transparency to boost the art market by bringing greater consumer protection and fairness to the contemporary art industry.

How does the platform work on a practical level? How can people engage with the project?

Anyone can engage in this provocation by buying inexpensive derivative artworks on Art-Derivatives.com in the form of digital images signed by me. These derivative artworks can eventually increase in value and be resold at a higher price through a sales contract that I have designed specifically for these works.

I created a pretty sophisticated system to calculate the prices and value increases of these derivative works, which guarantees ownership and their authenticity. The artworks f

or sale on Art-Derivatives.com are financial goods in the form of digital files. These files can be thought of as physical pieces of art composed of digital objects and their certifications by the artist.

These derivative artworks are sold as high-resolution JPGs via the website. Following the purchase, a digital document is issued via email with the sales agreement and the certification of authenticity signed by myself and the collector. These signatures and certifications are coded with cryptography and establish ownership and traceability of the artworks.

I’m not against the market and selling art that increases value over time. Being an artist and selling art is my job. I need money to be able to afford to do projects and maintain financial stability. Artists don’t have social security like a pension nor the funds even to produce new works sometimes. This project is somehow also very personal to me. These art auctions are creating a system that is extremely top-heavy and unfair for artists like myself and my peers. For this reason, I am trying to design a new form of digital art that can still be meaningful, interesting, and saleable.

You have used this tactic of scraping data from websites such as Facebook (Face to Facebook, 2011)5 and newspapers with paywalls (Daily Paywall, 2014)6. Still, this time the data comes from Sotheby’s auction data and artwork images. Do you expect any repercussions from this? What legal encounters have you had in regard to your projects in the past?

It’s hard to say how Sotheby’s will react. Every company has a different “personality”, like Facebook is much more reactive legally than Google. They were very aggressive with me, as much as Pearson [a multinational publishing and education company] that took down Daily Paywall.

It depends on how open-minded and collaborative they want to be. Sotheby’s looks like a conservative company, and I heard they already tried to shut down journalists doing investigations about them. So let’s see if they can bear this provocation.

The copyright controversy is the key; even though they sell appropriation art like gold and I’m stating clearly how I handle the copyright in this project, there might still be reasons to make them very upset.

There will also be a campaign for regulation that will be boosted aside from this direct provocation, so they will need to deal with a crossfire if they don’t want to collaborate. Nevertheless, it’ll look bad to censor an artist from speaking out and block efforts for innovation in the market.

What would you like to see be done differently in the art market? Do you see the project as a longer-term campaign?

There are straightforward things that can be done. These might look technical, but they are at the core of a healthy market. For instance, making the names of owners of artwork accessible and having IDs for the artworks. Shockingly, art auctions don’t even publish a unique ID for each item that is a basic of any market, from barcodes in a store to financial products.

How is it possible that in 2020 art auctions still hide the IDs of items and the owners who trade them? Not even Switzerland allows such financial opacity any longer. It just makes clear how much art auctions have to hide.

The other very controversial issue is not allowing manipulation of prices with the betting and buying by anonymous individuals or rings. It should be clear who is buying and what their interests are. For instance, third-party guarantees at auction that can speculate in complete anonymity are just a crime. Most of the prices published and recorded are not even real. There are many other related issues that I indicated in my research.

A healthy and fair art economy depends upon ethical rules. Transparency and regulation of art auction houses can re-establish confidence in the art trade, boost the market and make it just for all.

Your work goes back a long way in areas of media, technology and activism. Could you tell us about your transition to engage more actively within the art market? How did this shift occur, and how has your practice changed?

This project has some similarities with my work Loophole for All (2013)7, which also was addressing secrecy in the financial world through a participatory provocation in buying document evidence of secrecy in the Cayman Islands.

Mostly the theme and interventions in global politics, economics, and media have always been my main interest. With time, I refined the strategies and topics. Still, the art market has been a fascination and interest of mine for a long time, much before becoming a full-time artist working with galleries and institutions. I’ve been reading and analysing the market with a critical view but also understanding the potential for change; that’s how I got here after so many years and finally getting to the core issues.

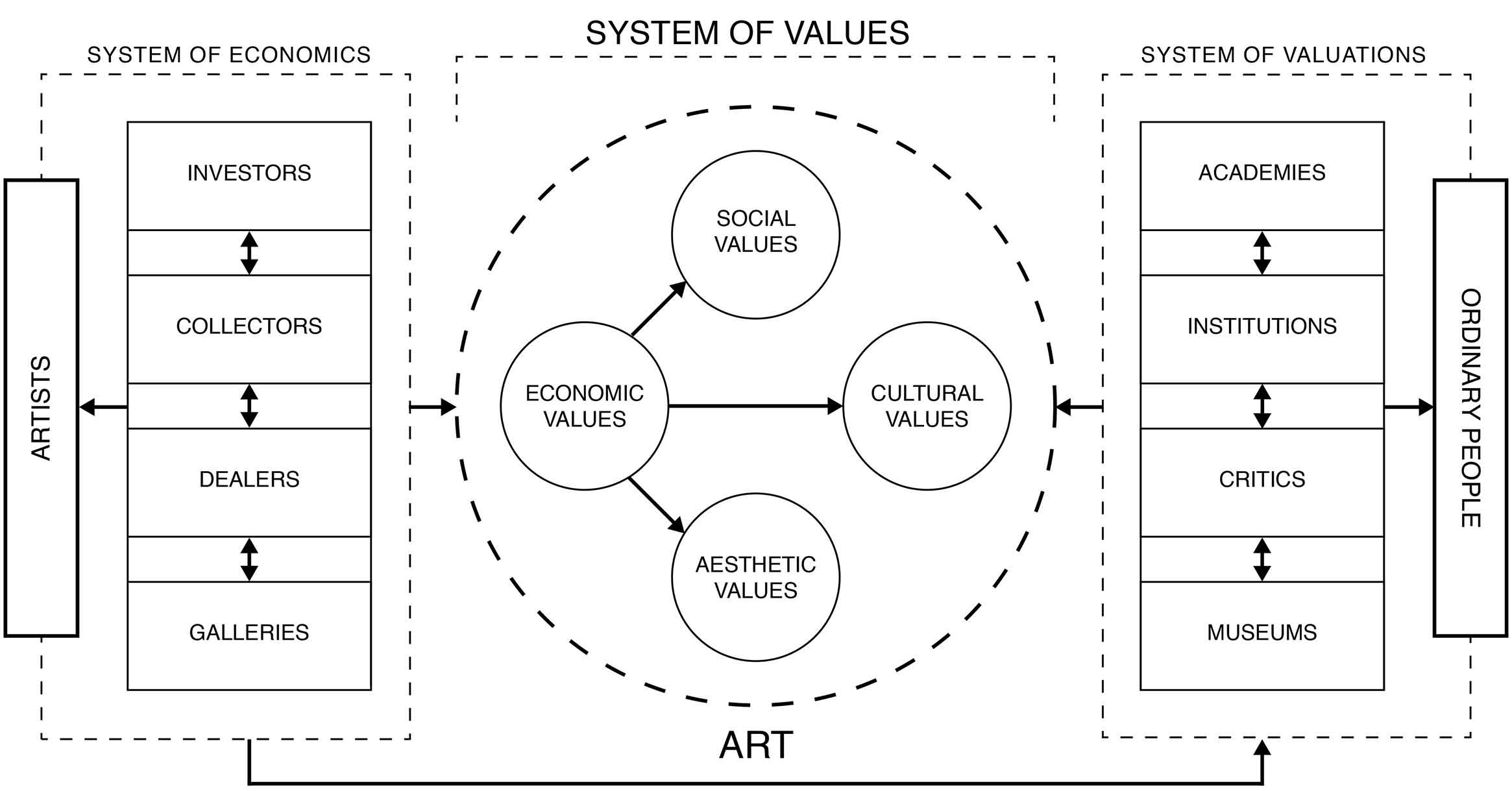

A previous project of mine about the art market is Art Commodities (2014)8, where I also discuss how aesthetic values and taste-making could be more socially-oriented. Today, this is already happening with increasing politically-engaged art even in the market and galleries that try to be more inclusive and socially conscious.

Soon we will look back at the art of the 90s and early 2000s as a dark age for art history. A lot of collectors lost their money already, and there will be even more. Art auction houses should be held accountable for the cultural and financial fraud they have orchestrated.

This is also a personal issue, with art being my full-time job. Now, I am directly involved in protecting my rights and labour. The market trends for me are very problematic at this point; sales are down when all it counts are high prices, social media likes, and ticket sales rather than the actual work by the artists and finding ways to support it.

These days big numbers are more important than the quality of art and accomplishments. Even though these numbers are inflated, where the majority of artists struggle to survive, while the top few get extraordinarily rich and become pseudo-celebrities.

I can’t blame the collectors and curators if they have to invest. They do it in something that they can resell, especially if they have to choose among the increasing supply of art. And this is how art auctions became central–they are the gatekeepers deciding what can be resold and what increases in value.

These days, I see even progressive collectors turning to artists who traded only through art auctions and dropping everyone else. Public institutions don’t operate much differently since they rely on collectors or on their acquisitions for exhibitions.

What are your thoughts on historical practices of institutional critiques, such as in the work of Hans Haack? In what ways do you see finance and the economy as a medium for artistic experimentation and intervention? Is it necessary for artists to reflect critically on the economies in which they operate?

I’m, of course, influenced by and a fan of Hans Haacke’s works, but also, other institutions critique artists playing out with the market as a material like Andrea Fraser and Marcel Broodthaers.

In my case, I follow that tradition by adding more layers and unique features. For me, this is online art, at once an action, a documentary, and a campaign. My material is thousands of unique pieces with direct real-time participation of the audience. The reactions that I can generate are global and instant without moving from my couch.

Beyond the creation and the shaping of this material, the research to investigate a topic, the provocation and the participatory elements, I also address my practice theoretically. For instance “Regulatory Art”9, “Evidentiary Realism”10, and “The Aesthetics of Social Complexity”11 are some of my writings aiming to articulate my work and ideas within art theory.

Finance and the economy are some of my mediums, as much as a law that wraps everything together. The contract by Seth Siegelaub (The Artist’s Reserved Rights Transfer and Sale Agreement, 1971) has been very influential on me and this project. That contract is the first attempt to regulate the market and make it thrive to benefit the artists. The sale agreement on Art-Derivatives.com is mostly based on it after 50 years.

It is still an essential instrument that is not used enough. This is the best example of how artists should reflect on the market in a propositive mode, not shallow or superficial. However, for most artists, it is an absolute taboo to criticise the art market or even reveal how they pay their bills. It’s a shame because until it is not discussed critically, nothing will change.

Besides the legal and economic discourses of this project, referring to conceptual art and institutional critique, there is something very visual and of immediate emotional impact. These images are all coded with numbers covering almost sacred images.

That’s how this work put in displays the speculative value of images in the representation of art as a financial instrument. As such, in this work, the images are seen through their financial qualities rather than their visual features and artistic merits. Somehow it’s both liberation and vandalisation of works of art that can be seen for what they are. Not just as artworks but as socio-economic conditions that make them exist in the first place.

What are other economies beyond auctions and the art market there for artists? Do you feel it is necessary to participate in the art market as an artist?

I don’t think there are many alternatives, surely artists can teach and apply for grants, but that is often not enough to survive, paying for productions, studio rent, or simply having free time to make art. The only real alternative could be more support from the state, like a basic income for artists and more public money for art institutions so that they don’t need to be so dependent on wealthy collectors and dealers.

Realistically, there is no art without the market. These days, it’s tough for an artist to be recognised without the representation of a gallery, sales, and dealers. I think it’s also because institutions like museums, biennales, and curators, but also art schools, are all dependent on the market to validate artists or to sustain their production.

Today, even grants and teaching jobs prioritise artists represented by galleries. Biennials and museums rely on galleries to pay for productions, publications, or shows. It’s sad, but being realistic is what an artist like me faces, and I, therefore, have to discuss the market as it is part of my labour condition and my career prospective.

Ideally, curators, critics, collectors, and academics should stop judging art based on their success in the market. This is actually at the core of this project–discussing how art is perceived through its financial success. This is something that corrupts the system of evaluation and the entire idea of art.

It is quite a challenge to ask large institutions like auction houses to change their ways. Do you feel commercial galleries like the blue-chip galleries and art fairs require regulation?

Indeed transparency should also exist in commercial galleries; that is already something happening like recently UK passed a new regulation12 that requires buyers of artwork to report their identity with a copy of the ID. In Europe, since 2018, there are also some caps on the amount that can be paid in cash and on reporting the identity of buyers13.

These regulations are great, but for decades there have been no such controls. And yet the art market is very international, and without coordination between jurisdictions, there are always subterfuges to get away. That’s also why private sales now happen often within freeports without moving the artworks or payments made from anonymous offshore companies.

Regulation should happen with international efforts by tackling a number of vehicles that are used in concert by mega galleries, dealers, collectors, and the auction houses who are the ones ultimately legitimising these practices.

It’s also important to distinguish the price difference between trading works worth a few thousand and works worth hundreds of millions. Small art galleries could be more transparent about their prices and collectors.

However, their business is often so weak that it would be mainly about reporting losses and debt, weakening, even more, their outlook. While art auctions are trading for hundreds of millions a month, and the records that they claim to make public are not reliable. Most of the public prices that they report are not the actual amount of the transactions.

It is an economy in which artists and galleries at the top only get richer while the rest struggle to survive, just as in the financial sectors in the age of neoliberalism. In the post-coronavirus era, can you imagine how these economies might be re-balanced or reconsidered to allow more artists to thrive?

I think there are several solutions available. For instance, taxing transactions over a million on work sold at auction, even 10% of one sale, would generate $100,000 in revenue that could go to public institutions to support artists doing less well in the market. Imagine, for each auction; there could be potentially millions to re-balance this inequality, and this only with 10% of taxation.

There are also more solutions, for instance, breaking the monopoly, considering auction houses as a cartel, a trust that is not allowing innovation to happen and other companies to trade. Exactly how Silicon Valley monopolies ruined the internet, the big art auction houses, Sotheby’s, Christy’s, and Phillips ruined the art world, killing competitors and monopolising the market.

Ultimately, a solution is also providing an alternative for the secondary market, making the resale of artworks ethical, accessible, and regulated. This might not even be about regulating auctions, but maybe by using fair resale contracts and dedicated alternative marketplaces. This effort can only come from changing the culture surrounding collecting and trading art.

What is your chief enemy of creativity?

The art world.

You couldn’t live without…

Culture.